The Rubber Economist Ltd

Natural rubber prices

The Rubber Economist Ltd

Natural rubber prices

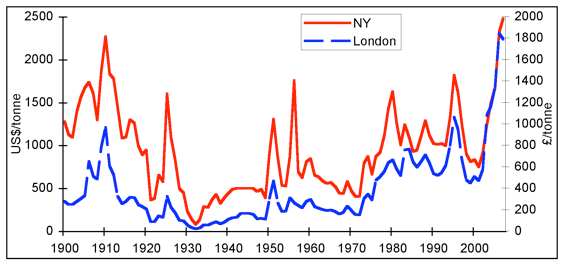

Natural rubber (NR) prices have broken a record high in the past two years. Consistent series of rubber statistics can go back as far as 1900. For NR prices, there are two series of prices which go back as far as that, i.e. annual pries of New York and London RSS1. As can be seen in the chart below, the average prices of both markets in 2006 and 2007 are the highest on record, exceeding the previous peaks in 1910 and 1995 (sharp increase in speculative demand).

Natural rubber prices in New York and London, 1990-2007

In recent years the presence of the weak US dollar and high oil prices, amongst other factors, has meant that most commodity prices including NR have increased quite sharply. However, in the long term, there is a general belief that there will be a structural surplus for many commodities. This is because of a long-run tendency for commodity consumption to decline while there is a tendency for output to increase due to various factors such as technological innovations. However, there is a factor, which may cause NR price to increase in the long term. NR is unique because the three major producing countries, namely Thailand, Indonesia and Malaysia, are among the world’s fastest growing economies and are likely to become the next generation of New Industrialized Countries, despite recent economic turmoil. This growth factor will influence global demand to continue to rise and the increase in supply to decline, hence, the NR industry will eventually face shortages. In the medium-term, elastomer prices depend mainly on the cyclical movement of the world economy. There will be movements along this gentle upward phase of the rubber cycle, influenced by various short-term factors such as weather, currency movements, futures markets activities and irregular demand.

While supply is expected to recover and there will be a slow down in demand. What will be the impact on rubber prices in 2008? The Currency factor and futures market are some important factors effecting rubber prices. The problem with NR prices is another important point of concern.

Contact [email protected] for rubber price forecasts or any problems you may need an answer to.

14th March 2009 - A new article has been written on Industrial pricing for NR.

9th December 2008 - Understanding the movement in rubber or commodity prices is quite complicated. A new section on Commodity prices in 2008 discusses some of the problems.

Copyright © 2008 - The Rubber Economist Ltd, All rights reserved.

Please contact [email protected] for more information.